Table of Contents

-

The Legal Status of CBD in Europe

Novel Food Rules for Edible CBD Products

Legality of CBD Flowers and Buds

CBD E-liquids and Vape Product Regulations

CBD Cosmetics Regulation in Europe

Country-by-Country Overview

Recent Regulatory Changes (2022–2025)

How Regulations Impact CBD Businesses

Key Points on CBD Legality in Europe

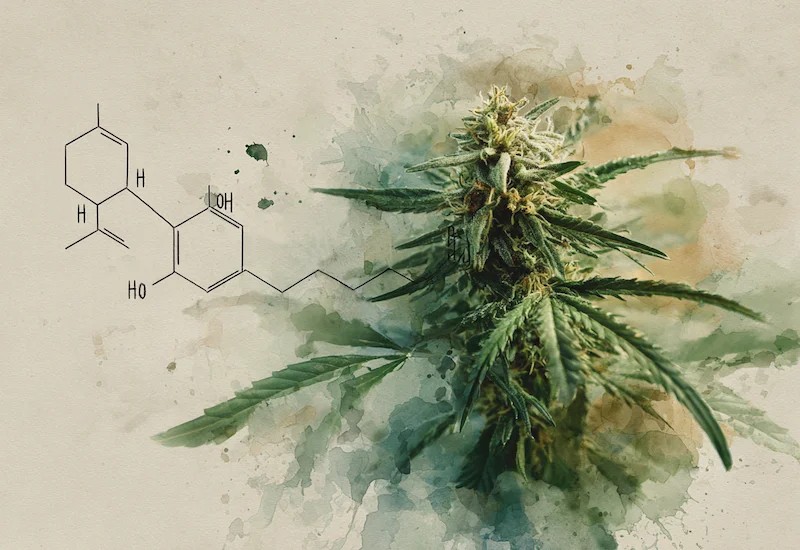

The Legal Status of CBD in Europe

CBD is generally legal across much of Europe, but the details depend heavily on local laws and product types. Regulations vary by country in terms of allowable THC content, approved product formats, and compliance requirements. While many nations permit CBD products with THC levels below specific thresholds, these limits are not always consistent.

For example, EU rules currently allow hemp cultivation with up to 0.3% THC, but many member states still enforce stricter limits on finished consumer products, often requiring levels at or below 0.2%. Some countries, such as Norway and the UK, mandate that CBD products contain no detectable THC at all.

Beyond THC thresholds, the legal landscape also depends on how a product is classified. Edibles and food supplements generally require approval as novel foods. Cosmetics must meet European safety and labelling regulations. Vape liquids and e-liquids can be further regulated under tobacco and nicotine laws, even if they contain no nicotine.

Manufacturers and retail brands should evaluate each target market’s rules carefully, tailoring formulations, labelling, and documentation to meet local regulatory requirements.

Novel Food Rules for Edible CBD Products

Edible CBD products face stricter regulations in Europe than many other formats. Under EU Regulation 2015/2283, CBD added to foods and supplements is classified as a novel food, meaning it requires specific safety assessment and approval before it can be sold legally.

Although many CBD products are on the market, formal approval processes remain slow. The European Food Safety Authority (EFSA) has paused some application reviews to gather more data on CBD’s safety, which means no EU-wide approval has been granted for edible CBD products yet.

This has several implications for manufacturers and retail brands:

-

Approval is required to market CBD edibles or supplements legally in the EU.

-

Applications can take significant time and may face additional data requirements.

-

Products sold without approval risk enforcement action or removal from shelves.

-

Some individual EU countries may tolerate certain products, but this is not a legal authorisation at EU level.

These challenges mean many brands prioritise non-edible CBD formats with fewer regulatory hurdles. For those entering the edible market, it is important to understand the novel food process and local enforcement to plan effectively.

Legality of CBD Flowers and Buds

The legality of CBD flowers (often called buds) is particularly complex across Europe. While hemp-derived CBD itself is generally legal, the sale of raw CBD-rich plant material can be heavily restricted or regulated.

Key considerations for manufacturers and retail brands:

-

Most EU countries set a THC threshold of 0.2% or 0.3% for hemp cultivation, but that does not automatically legalise selling CBD flowers for smoking or consumption.

-

Many countries prohibit marketing CBD buds for smoking due to tobacco regulations, public health laws, or efforts to prevent confusion with cannabis containing high THC.

-

Examples of national rules:

– Spain: CBD buds are not illegal in themselves but cannot legally be sold for smoking. Read more about CBD legality in Spain.

– Switzerland (non-EU): Allows CBD products with up to 1% THC, including flowers, creating a different standard.

– Italy: Tolerates some CBD flower sales, but local enforcement varies and labelling restrictions apply.

Because of these country-specific rules, selling CBD flowers in Europe requires careful legal review and robust compliance planning. Brands must understand local marketing restrictions, labelling obligations, and enforcement risk before entering this segment.

CBD E-liquids and Vape Product Regulations

CBD e-liquids are generally permitted in many European markets, but manufacturers and retail brands must understand that regulations still vary by country. These products typically require non-detectable THC levels to comply with local laws, ensuring they cannot be confused with cannabis products containing psychoactive THC.

Even when THC-free, CBD e-liquids may fall under national tobacco or ENDS (Electronic Nicotine Delivery Systems) regulations. This can include rules about packaging, labelling, age restrictions, and distribution channels. For example, while Spain prohibits the marketing of CBD buds for smoking, it does allow the sale of CBD e-liquids for vaporisation, reflecting how product format can determine legal treatment.

Brands planning to enter this segment need to consider local variations in classification and ensure their products meet all safety, labelling, and distribution requirements in each target market. Working with experienced partners can help ensure these compliance steps are managed effectively and consistently across borders.

CBD Cosmetics Regulation in Europe

CBD cosmetics represent an important opportunity for brands entering the European market, but they must comply with specific regulatory requirements. In early 2022, the European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs added plant-derived CBD to the CosIng database, providing guidance for EU member states on its use in cosmetic products. This inclusion supports the safe and consistent use of CBD in skincare and personal care formulations.

However, being listed in the CosIng database does not automatically authorise a product for sale. All CBD cosmetics sold in the EU must be properly registered on the Cosmetic Product Notification Portal (CPNP) by the responsible company. This process ensures that products meet safety standards, include accurate ingredient disclosures, and comply with labelling requirements.

At Hempo Solutions, we understand these requirements and can help partners navigate the CPNP registration process and other regulatory obligations. This support ensures that CBD cosmetics are not only high quality but also fully compliant with European standards, helping brands build consumer trust and long-term success in this growing market.

Country-by-Country Overview

European CBD regulations are highly fragmented, with each country applying its own rules on THC limits, permitted product formats, and marketing restrictions. This complexity means that a one-size-fits-all approach rarely works for brands planning to sell across the region.

Below is an overview of typical THC limits and the general legal status of CBD products in selected European countries. It is essential to note that these figures can change and that local enforcement and interpretation may vary. Brands should always verify local rules and seek professional guidance before launching in any market.

| Country | THC level | CBD oil status |

|---|---|---|

| Belgium | ≤ 0.2 % | Legal |

| Croatia | ≤ 0.2 % | Legal |

| Czech Republic | ≤ 0.3 % | Legal |

| France | ≤ 0.3 % | Legal |

| Germany | ≤ 0.2 % | Legal |

| Italy | ≤ 0.3 % | Legal |

| Spain | ≤ 0.2 % | Legal |

| Lithuania | ≤ 0.2 % | Legal |

| Estonia | ≤ 0.2 % | Legal |

| Latvia | ≤ 0.2 % | Legal |

| Finland | ≤ 0.2 % | Legal |

| Sweden | 0% | Legal (no-THC) |

| Norway | 0% | Legal (no-THC) |

| UK | ≤ 0.2 % | Legal |

| Poland | ≤ 0.3 % | Legal |

| Slovenia | ≤ 0.3 % | Legal |

| Denmark | ≤ 0.2 % | Legal |

This table is a starting point for assessing market opportunities. It highlights the importance of country-specific compliance in developing, labelling, and marketing CBD products. Hempo Solutions partners with brands to help them understand these regulations and adapt products and documentation to meet local requirements reliably.

Recent Regulatory Changes (2022-2025)

Europe’s regulatory landscape for CBD is evolving rapidly. Manufacturers, brands, and distributors must stay up to date on these changes to ensure ongoing compliance and market success. Below are some of the most important recent developments.

EU Common Agricultural Policy (CAP) Update

In 2023, the EU revised its Common Agricultural Policy rules to increase the maximum permitted THC content for industrial hemp cultivation from 0.2 % to 0.3 %. This change aligns cultivation rules with global markets, making sourcing and farming more flexible.

However, it is important to note that finished consumer products often remain subject to stricter national THC limits, which can still be 0.2 % or even zero in some countries. Brands must confirm requirements in each target market before launch.

Novel Food Approvals

CBD is classified as a novel food in the EU, requiring pre-market authorisation to be sold legally as an edible or supplement. While dozens of applications have been submitted to the European Food Safety Authority (EFSA), the agency has paused formal approvals pending further safety data.

This means no EU-wide approvals have been finalised yet. Businesses must plan carefully, understanding that edible CBD products still face significant regulatory hurdles and require local legal review to avoid enforcement risks.

CosIng Database Inclusion

In 2022, the European Commission added plant-derived CBD to the CosIng database, which guides member states on cosmetic ingredient rules. This inclusion supports the safe, consistent use of CBD in skincare and personal care products.

However, it does not provide automatic authorisation for sale. Brands must still register products through the Cosmetic Product Notification Portal (CPNP) and ensure they meet all EU safety and labelling standards.

2025 Outlook

Looking ahead, the EU is expected to work toward greater harmonisation of CBD regulations. Efforts are underway to streamline novel food approvals, standardise labelling requirements, and reduce national variations that complicate cross-border trade.

While these changes promise a more accessible European CBD market, brands need to plan proactively now. At Hempo Solutions, we help partners navigate these evolving rules, adapt to new requirements, and stay compliant as the regulatory environment matures.

How Regulations Impact CBD Businesses

Navigating Europe’s complex CBD regulations is essential for any manufacturer or retail brand planning to enter the market. While CBD is legal in much of Europe, compliance is rarely straightforward and depends on understanding country-specific rules, product classifications, and evolving legal frameworks.

Manufacturers and distributors must account for:

-

THC Limits: Different countries enforce varying maximum THC thresholds, often between 0.00 - 0.03 %, with some enforcing zero-tolerance policies. Ensuring consistent testing and documentation is crucial for meeting these limits.

-

Product Categories: Edibles, supplements, cosmetics, and vape products each have distinct regulatory requirements. For example, CBD foods require novel food approval, while cosmetics need CPNP notification.

-

Local Enforcement: Even within the EU, member states interpret and enforce regulations differently. Businesses must be prepared to adjust labelling, documentation, and formulations to meet national rules.

-

Supply Chain Documentation: Clear sourcing records and third-party lab tests help demonstrate compliance, reduce risk at customs, and build trust with retailers and consumers.

Ensuring alignment with EU and local regulations at every production stage, from sourcing to packaging, is critical. Hempo Solutions advises partners on achieving consistent compliance to support confident market entry.

Key Points on CBD Legality in Europe

For businesses looking to enter the European CBD market, understanding the legal landscape is essential. While CBD is widely permitted across many countries, regulations remain complex and require careful planning and compliance at every stage.

Key points to remember:

-

CBD legality depends on country-specific rules covering THC limits, product types, and marketing restrictions.

-

THC thresholds vary, typically ranging from zero tolerance to 0.3 percent, with strict enforcement in some markets.

-

Product classification matters. Edibles and supplements require novel food approval, cosmetics need CPNP notification, and e-liquids may fall under tobacco or ENDS rules.

-

Local enforcement and interpretation can differ significantly, even within the EU, requiring tailored labelling and documentation for each market.

-

Supply chain transparency is essential. Sourcing high-quality hemp, maintaining testing records, and meeting EU safety standards support compliance and build trust.

For companies looking to expand into Europe, a strong understanding of these legal nuances is crucial. Careful planning and expert guidance can help brands navigate evolving rules, reduce compliance risks, and enter new markets with confidence. Therefor its important to know how to choose the right CBD manufacturer for your business. Hempo Solutions has the experience and knowledge to support businesses at every stage of this process, ensuring products meet all necessary requirements for successful market entry.